E’ sostenibile il debito pubblico italiano? Stiamo messi così male da rappresentare un pericolo per la costruzione europea? Qualche dato per aiutare a capire il reale stato delle cose e le prospettive, da Saker Italia.

Tag: Financial markets

May 30

Markets turmoil and the Italian job

Is there a fierce struggle between France and Germany behind the minuet of the Italian President of the Republic and his refusal to appoint the yellow-green Government? Or, instead, “Salvini and Di Maio are on the Soros’ payroll?”, asks prof. Arrigo, professor of economy (read the full interview on Il Fatto Quotidiano). The “God of …

Apr 30

Are the Greek Government’s goals so far from Troika’s?

“The current disagreements with our partners are not unbridgeable. Our government is eager to rationalize the pension system (for example, by limiting early retirement), proceed with partial privatization of public assets, address the non-performing loans that are clogging the economy’s credit circuits, create a fully independent tax commission, and boost entrepreneurship. The differences that remain …

Apr 14

BRICS and the Fiction of “De-Dollarization”

An interesting essays of Prof. Michael Chossudovsky published on Global Research dismantles the position of “the financial media as well as (of) segments of the alternative media (that) are pointing to a possible weakening of the US dollar as a global trading currency resulting from the BRICS (Brazil, Russia, India, China, South Africa) initiative” to …

Mar 27

Bank of England undermines the Classic Money Creation Theory

“In exceptional circumstances, when interest rates are at their effective lower bound, money creation and spending in the economy may still be too low to be consistent with the central bank’s monetary policy objectives. One possible response is to undertake a series of asset purchases, or ‘quantitative easing’ (QE)… As a by-product of QE, new …

Jan 25

Italy for sale #4: how to became the owner of the Central bank and earn easy money

Great deals for Italian banks. The privatisation law of Bank of Italy was definitively approved yesterday. It brings huge earnings to the private banks holding the shares of the Central Bank nd the chance to buy new stocks for foreign banks, amongst the protest of minority groups in the Parliament. Notwithstanding the 262/2005 law which …

Dec 04

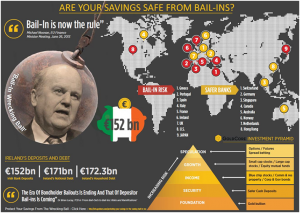

Bail-ins and deposit confiscation

From comedonchisciotte.org the (old) ‘Future of Banking in Europe’ Conference report (with some commercial interest by goldocore.com for example) is shocking… One of the aspects of the new negotiation on the European union will be a ‘bail-in’ of deposits when banks fail in the future. Michael Noonan, Ireland’s Minister for Finance at the time, confirmed …