China has had enough. The Country of Great Wall is working at a “de-Americanized” world. A commentary of Xinhua, a State controlled press agency, explains how and why and launches the idea of Petroyuan. “With its seemingly unrivaled economic and military might, the United States has declared that it has vital national interests to protect …

Tag: Financial markets

Jun 23

Self-fulfilling prophecies

Italy seizing up in a Mediobanca Security report to its customers, uncovered by ilfattoquotidiano.it. Mediobanca Securities report from ilfattoquotidiano The Country is also in the “blacklist” of European peripheral States —Greece, Spain, Portugal and Italy— where Constitutions with “a strong socialist influence” might put them at the center of the debt crisis, a J. …

Mar 03

Finance ‘votes’ for Grillo and Berlusconi

A pre-electoral report by Mediobanca Securities forecasted the incredible results of Mr Grillo and Mr Berlusconi in the Italian vote of 24-25 February 2013, and indicated it as the best scenario for financial operators worldwide (read the scoop by Il Sole 24 Ore on 18th February 2013). “Paradoxically, the worst case scenario could actually become …

Sep 13

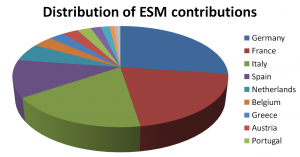

The German Constitutional Court’s “yes-but” answer to the ESM Treaty

The conditional approval of the ESM’s rules by Karlsruhe judges limits the secrecy of bailout agreements, in the name of the citizens’ right to be informed. It comes after 37.000 Germans signed the petitions against unlimited funding to ESM by Germany. The Court’s decision orders the two Chambers of the German Parliament be fully informed …

Sep 12

BBA warned banks on LIBOR-EURIBOR rate-rigging

The British Bankers’ Association (BBA) issued a warning to banks in April 2008 to “submit honest rates” to its Libor setting panel. One email, dated 21 May 2008, appears to show that Angela Knight, the chief executive of the BBA, was aware of the potential for banks to submit rates not reflecting the price at …

Aug 29

The ECB’s role against spread

Beyond the debate over the pros and cons of direct ECB’s actions to sustain the price of European bonds under attack, Andrew Bosomworth, managing director of the German office of Pimco, the world’s largest investor in government bonds, fears that the new program will mainly attract speculators rather than long-term lenders. “If interest rates for …

Jul 25

“Stop socialism”… and “information theft”

There is a bit of humor in the paper presented by the SPD leader Sigmar Gabriel against dominant policies for banks bailout with public money, and States sinking with economic and social disasters. However, both that paper (presented in this interview to Tagesspiegel) in Germany and the plea to stop ‘information stealing’ on economic and …